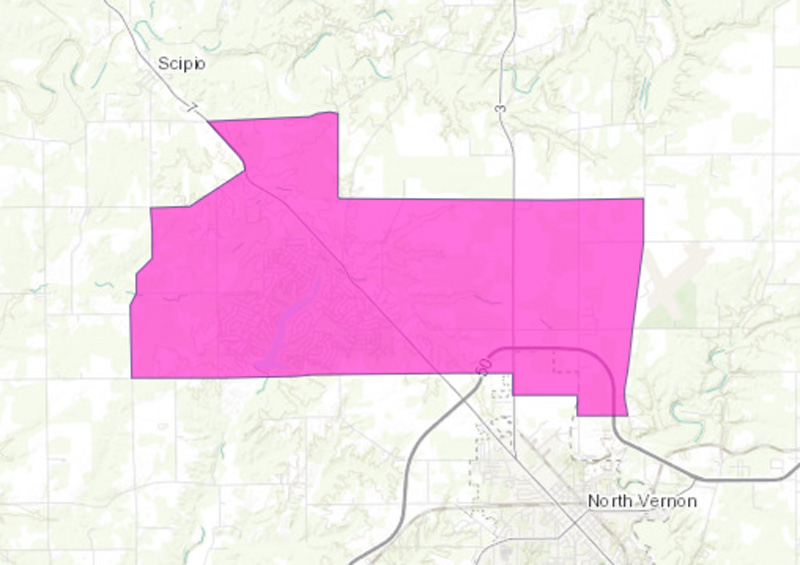

The Tax Cuts and Jobs Act of 2017 (P.L. 115-97) allowed governors to nominate certain census tracts as Opportunity Zones, subject to approval from the U.S. Department of the Treasury. Up to 25% of a state’s low-income census tracts were eligible for designation.

The 156 Opportunity Zones in Indiana were selected based on a combination of factors including existing economic development programs and local coordination, economic and community data, the likelihood of attracting short- and long-term investment, and growing industry sectors within the community.